Covid-19

Recovery Loan Scheme (RLS) vs. AltFi products – how do they compare?

29 Mar 2021

The CBILS, CLBILS and BBLS all came to an end on 31 March 2021. Launching on 6 April, The Recovery Loan Scheme (RLS) is the much anticipated replacement. But is it the best option on the lending market, and how does it compare to the other alt-fi products out there?

As with the previous coronavirus loan schemes, the Recovery Loan Scheme enables businesses to improve their cash flow by providing them with a working capital boost.

However, business owners shouldn’t feel like they have to wait for the RLS – there are lots of other finance types out there that serve a similar purpose. See my available funding options now.

How does the RLS compare to the CBILS?

Before we run through some alternative options, let’s take a look at what the RLS has to offer and how it compares to the legacy CBILS.

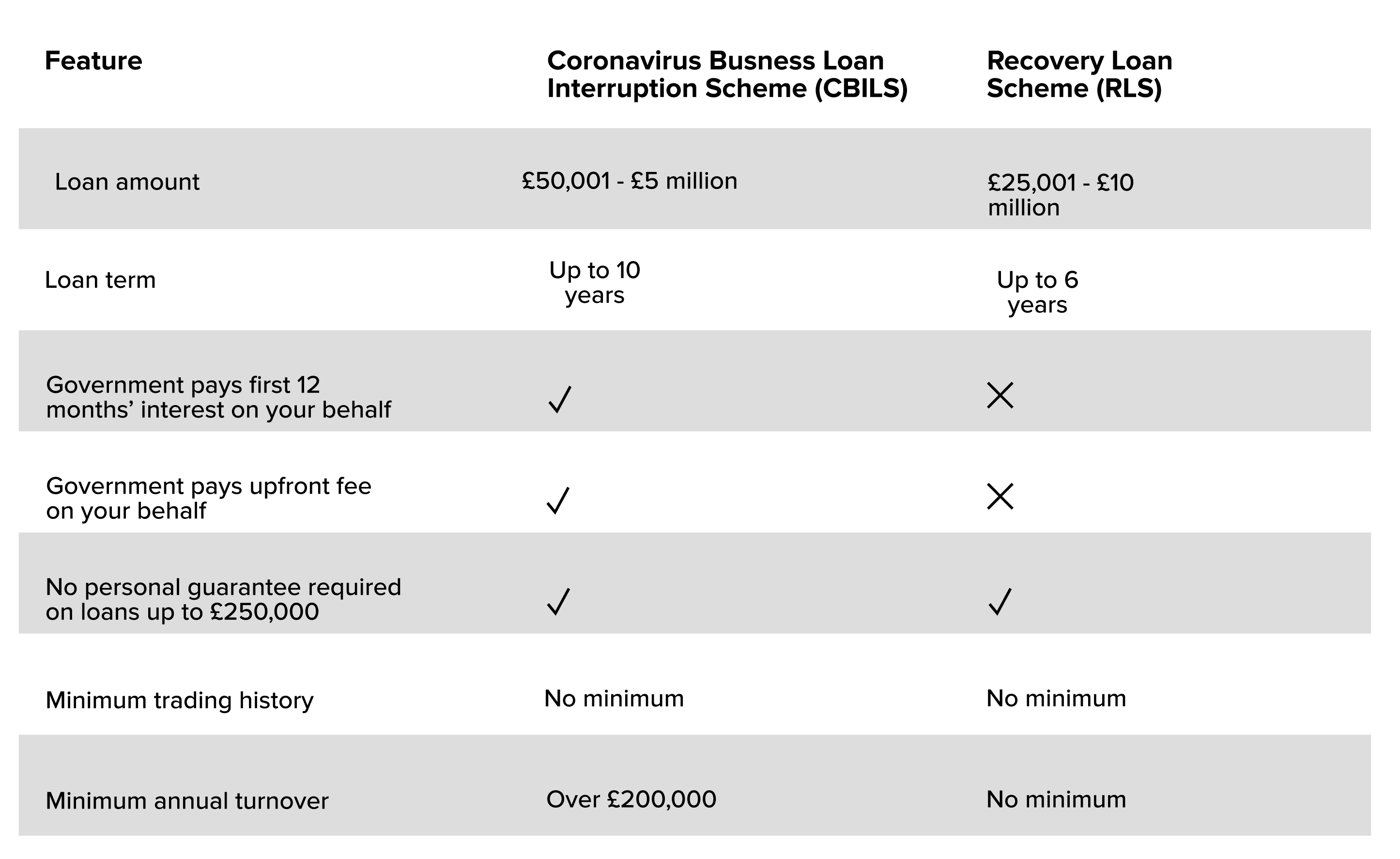

As the table below illustrates, the two schemes share some similarities. For example, no personal guarantees are required for facilities under £250,000. There are some clear differences too: the Government covered some of the costs of the CBILS, while the RLS is designed for a wider range of businesses and the loan amount available is higher.

Table 1: CBILS vs RLS

CBILS vs. RLS Comparison Table

Recovery Loan Scheme: benefits & considerations

It’s always important to understand the ins and outs of a loan before you apply. The scheme is yet to be fully defined (the British Business Bank is going to release more information shortly), however we do already know a few key details.

Term length: term loans and asset finance facilities are available for up to six years, with overdrafts and invoice finance available for up to three years.

No eligibility restrictions: no minimum trading history or minimum annual turnover for businesses accessing the scheme.

No personal guarantees on loan amounts under £250,000.

Unlike CBILS, businesses will have to meet all interest payments and fees associated with their RLS facility.

How many products are there?

A wide range of finance products will be available under the RLS, including term loans, overdrafts, asset finance and invoice finance facilities. The maximum value of each facility provided under the scheme will be £10m per business.

The minimum amount a business can apply for will vary. For asset finance and invoice finance, the minimum is £1,000. Term loans and overdrafts start at £25,0001.

Unlike CBILS, businesses will have to meet all interest payments and fees associated with their RLS facility.

Who’s offering the RLS?

The RLS will be administered by the British Business Bank (BBB) and financing products will be lent via accredited lenders. The BBB will announce this list over the coming weeks.

If I can't get a CBILS can I get the RLS?

If you weren’t eligible for the CBILS, you might be able to access a facility through the RLS.

The scheme isn’t fully defined yet and it’s going to take a while to find out the specific details. In the meantime, there are lots of other finance products available...

Have you considered these Alt-Fi finance types?

1. Revolving credit facility

A revolving credit facility is a flexible type of borrowing that lets you access funds when you need them and only pay interest when it is being used. Like a business credit card of overdraft, you're given a credit limit.

You can think of it as a form of financing that you can tap in and out of when you need it. The flexibility of revolving credit facilities make them a viable option for SMEs that require a quick working capital boost.

2. Asset finance

When you need a vehicle or piece of equipment or machinery to enable you to operate properly (or grow your business), the sheer expense can seem like an insurmountable challenge. That’s where asset finance comes in.

Asset finance enables you to spread the cost of the asset over a longer term, making the process more affordable. The Government is currently incentivising businesses to invest in new assets through its super-deduction tax break.

3. Invoice finance

You can borrow money based on what your clients owe (via your debtor book) using invoice finance. It means that instead of waiting weeks or even months to receive the funds, you can get most of the money straight away. Here’s how it works:

You invoice your clients/customers

You then pass on the invoice details to your finance provider

They pay you an agreed percentage, often within 48 hours

You chase the payment as usual or your provider can, depending on the agreement

When the invoice is finally paid you receive the rest of the funds minus any fees.

4. eCommerce finance

y5. Merchant cash advance

Non-essential businesses, gyms, pubs and others will be able to reopen on 12 April. We anticipate that some of these businesses will be looking for a flexible form of finance to set them up for success during the period of transition.

If you’re in this position and are currently trading, you could be eligible for a merchant cash advance. Merchant cash advances are specifically designed for businesses that take customer card payments. You can borrow a lump sum and pay it back bit by bit through a percentage of your customer card payments.

Because the amount you pay back each month depends on how much trade you’re doing, it can make the repayments more affordable compared with a traditional term loan where you pay the same amount each month, regardless of how much trade you’re doing.

6. Early repayment business loans

Short-term loans can help you cover costs in the interim, until you can pay off the finance or get a longer term loan and refinance your debt. Short-term loans tend to have a quick approval process too, so can come in handy when you need finance fast.

What’s next?

At Funding Options, we processed over £760M in CBILS loans and partnered with a panel of 40 lenders offering CBILS. Once the full details have been announced, you’ll be able to apply to the Recovery Loan Scheme to access finance for your business.

But don’t feel like you need to wait on the RLS when there are many other products out there today that might be more suited to your needs.

Start exploring your business finance options today.

See my funding optionsBusiness Finance

Check your eligibility using our online form without affecting your credit score.

Apply hereSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.